- Business Strategy Advisory, Tax

Important Use Cases for HoldCos and SPVs

- | November 10, 2025

What are HoldCos and SPVs?

Holding companies (HoldCos) and Special Purpose Vehicles (SPVs) are both legal entities used to organise and manage business activities, but they may serve very different purposes. A holding company is a parent entity that owns and controls other companies, typically overseeing their strategy, governance, and capital allocation without engaging directly in day-to-day operations.

An SPV, on the other hand, is designed to isolate financial and legal risk. It may hold a specific asset or conduct a specific project or investment. Because an SPV is a distinct company, its obligations are also limited to its own: if the parent company runs into trouble, the SPV’s assets and liabilities are insulated, and vice versa.

| Feature | Holding Company (HoldCo) | Special Purpose Vehicle (SPV) |

|---|---|---|

| Purpose | Owns and controls subsidiaries; manages governance, strategy, capital allocation. | Isolates specific project/asset risks; used for financing, securitisation, or regulatory purposes. |

| Operations | Oversees but does not directly run day-to-day business. | Limited to a specific project or asset. |

| Risk Segregation | Losses from one subsidiary do not affect others. | Parent’s assets are insulated from SPV liabilities. |

| Typical Uses | M&A, family offices, diversification, and IP holding. | Asset securitisation, JV projects, tax structuring. |

In this article, we look at some major use cases of holding companies and SPVs.

Important Use Cases of Holding Companies and SPVs

1. Risk Isolation

One of the most important uses of both holding companies and SPVs is to isolate risk. By placing different ventures or assets in separate legal entities, these structures ensure that if one venture fails or faces a lawsuit, the losses do not spill over to the rest of the group.

2. Asset Securitisation

SPVs are often used for asset securitisation. For example, if a bank wants to convert its receivables and loans into cash immediately, it can create an SPV that buys those assets. The SPV then issues securities or bonds to investors, using the proceeds to pay the bank for the assets. Because the SPV is legally separate, the new debt securities remain off the parent bank’s balance sheet. This suggests that even if the borrowers default, the losses are contained within the SPV, and the bank’s balance sheet remains protected.

3. Joint Ventures and Project-Specific Companies

When two or more parties want to collaborate on a business venture without merging their whole companies, they often form a joint venture (JV), usually by creating a new entity (often structured as an SPV).

4. Intellectual Property Holding and Franchising Structures

Another important use case, typically for holding companies, is to hold intellectual property (IP) and other critical assets in separate subsidiaries. Companies often separate valuable trademarks, patents, or brand names from their day-to-day operating units. The IP can reside in a holding subsidiary, which then licenses it to operating companies or franchisees.

5. Tax Optimisation

If one subsidiary makes a profit and another reports a loss, a holding company can offset the two, often lowering the overall tax. SPVs are sometimes created to take advantage of different tax treatments for different types of assets.

6. Mergers, Acquisitions, and Corporate Restructuring

Holding companies are common vehicles for M&A activity. When one company acquires another, the acquired company often becomes a subsidiary rather than being merged outright. In Google’s 2015 reorganisation into Alphabet Inc., Google became a subsidiary of Alphabet, separating its core profitable operations from riskier “moonshot” projects and giving investors clearer visibility into each business segment.

7. Family Ownership and Succession Planning

A family holding company can consolidate all of a family’s business interests, investments, and properties. This allows for centralised governance and controlled transfer of wealth to the next generation without fragmenting ownership among heirs.

8. Diversification and Conglomerate Management

When a business expands into multiple industries, the holding company model allows each line of business to be a separate subsidiary. The parent company allocates capital, sets strategic priorities, and evaluates performance without operational entanglement between subsidiaries.

9. Startup Financing and Investor Pooling Vehicles

SPVs have become popular in venture capital to pool multiple investors into one entity that invests in a startup. This simplifies the startup’s shareholder structure and makes it easier for investors to manage their stake.

10. Regulatory Licensing and Market Entry

In highly regulated industries, companies may use an SPV or holding company to meet local licensing requirements without exposing their entire business to that jurisdiction’s risks.

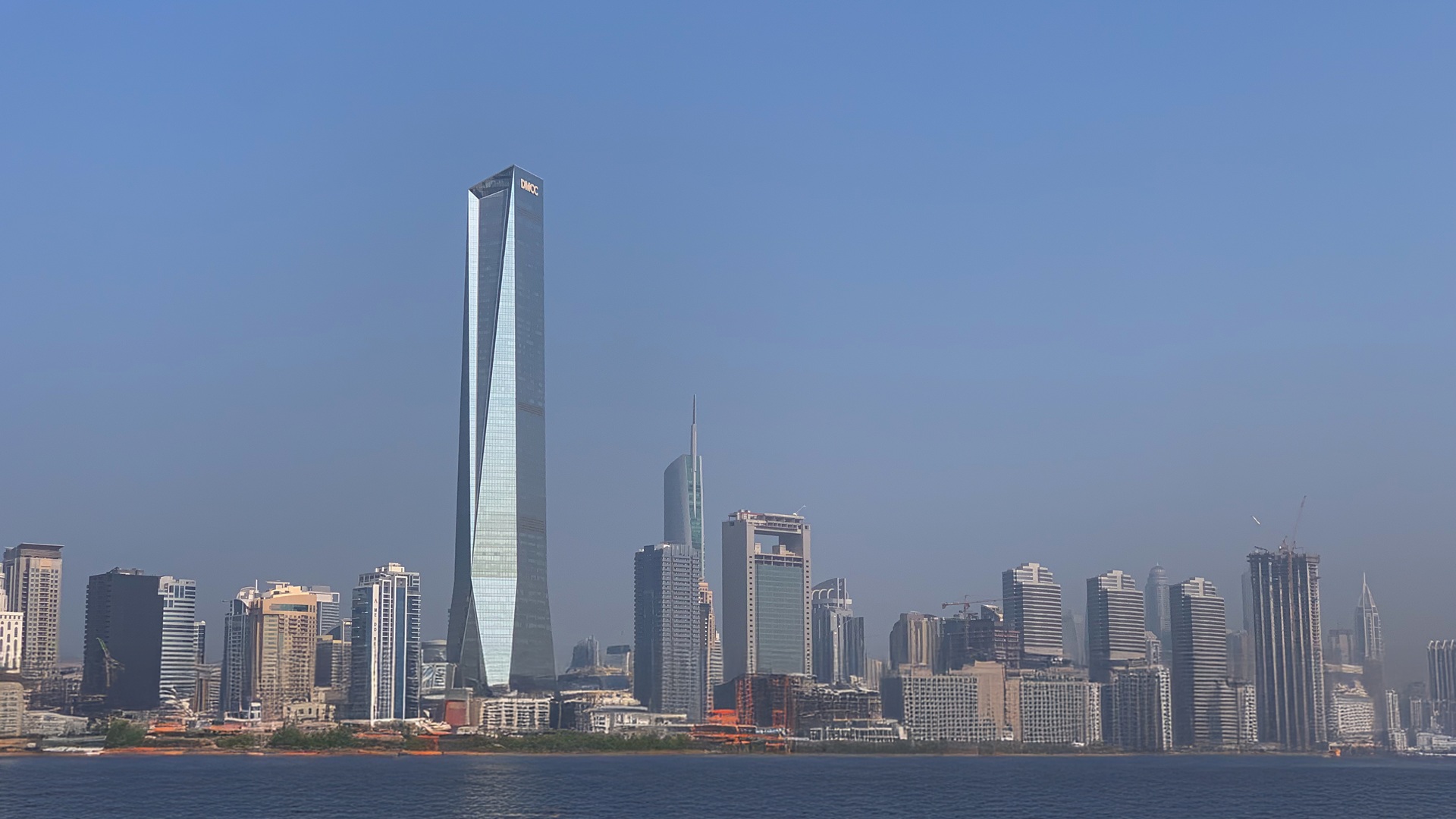

AKW Consultants: Licensed DMCC Registered Agent for Holding Companies and SPVs

The Dubai Multi Commodities Centre (DMCC), one of the leading free zones worldwide, offers both SPVs and holding companies for asset management, investment holding, and group ownership. These licences have proven especially attractive for family offices, investment firms, and multinationals entering or expanding in the UAE.

Businesses in DMCC can establish their SPV or holding company as a Limited Liability Company (LLC) or Company Limited by Guarantee (CLG) and operate without a physical office for business activities.

AKW Consultants, as a licensed DMCC Registered Agent, supports clients in structuring and licensing Special Purpose Vehicles (SPVs) and holding companies (HoldCos) to meet DMCC’s regulatory requirements. AKW Consultants also works with a diverse client base, ranging from family offices and HNWIs to multinational corporations, helping them establish SPVs and HoldCos. We are also the 2025 winner of DMCC’s Rising Star Award, recognised for delivering significant impact in the UAE’s consulting space. This award reflects, among other things, our impeccable track record of assisting businesses in choosing the correct business structure based on their operations and goals.

Connect with us to explore how AKW Consultants can help you establish your SPVs and HoldCos in DMCC.