- Compliance, Crypto and Virtual Assets

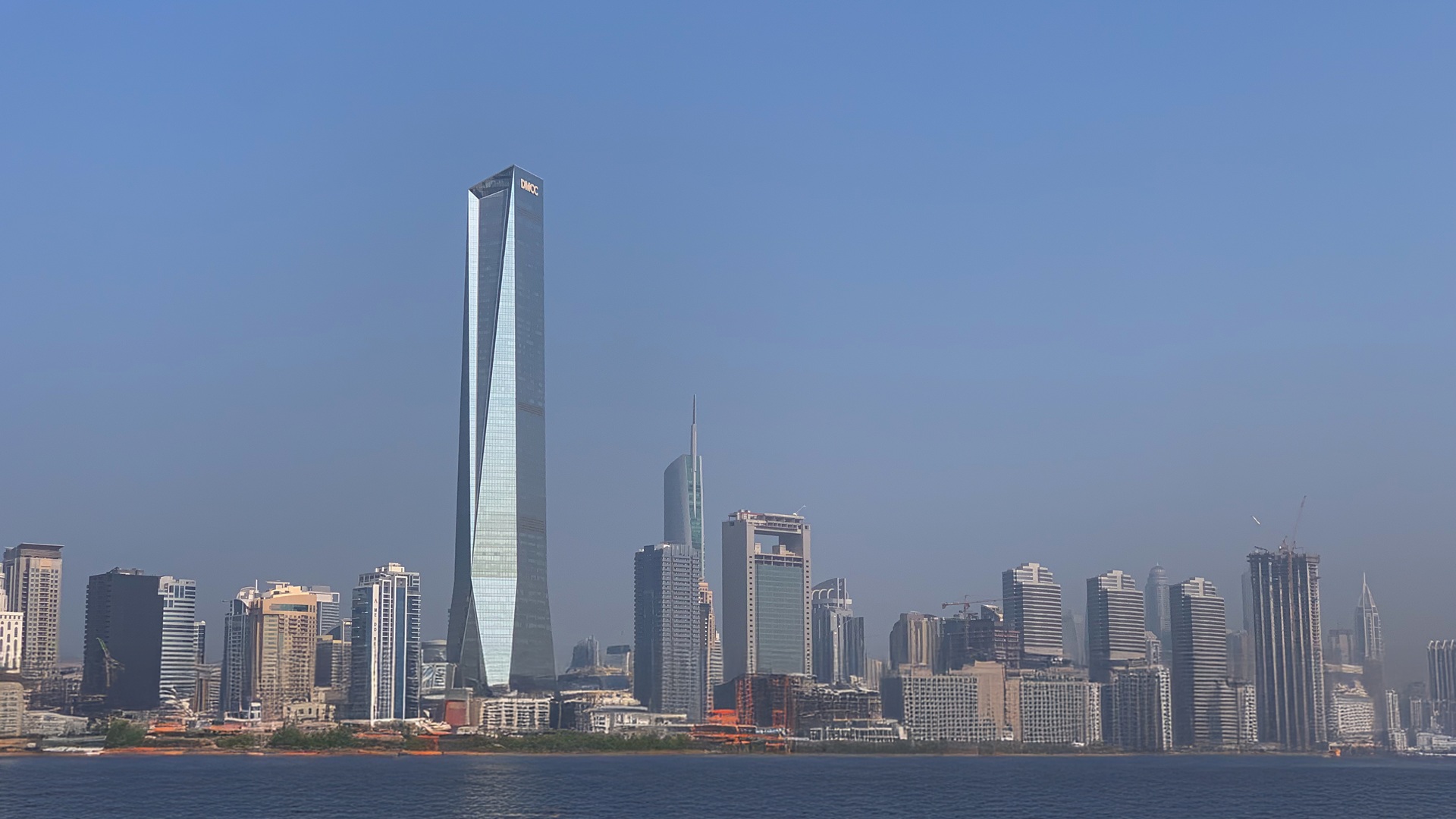

Dubai’s Tokenized Future How Real Estate Tokenization is Redefining Property Ownership

- | November 10, 2025

Tech Innovation in the Real Estate

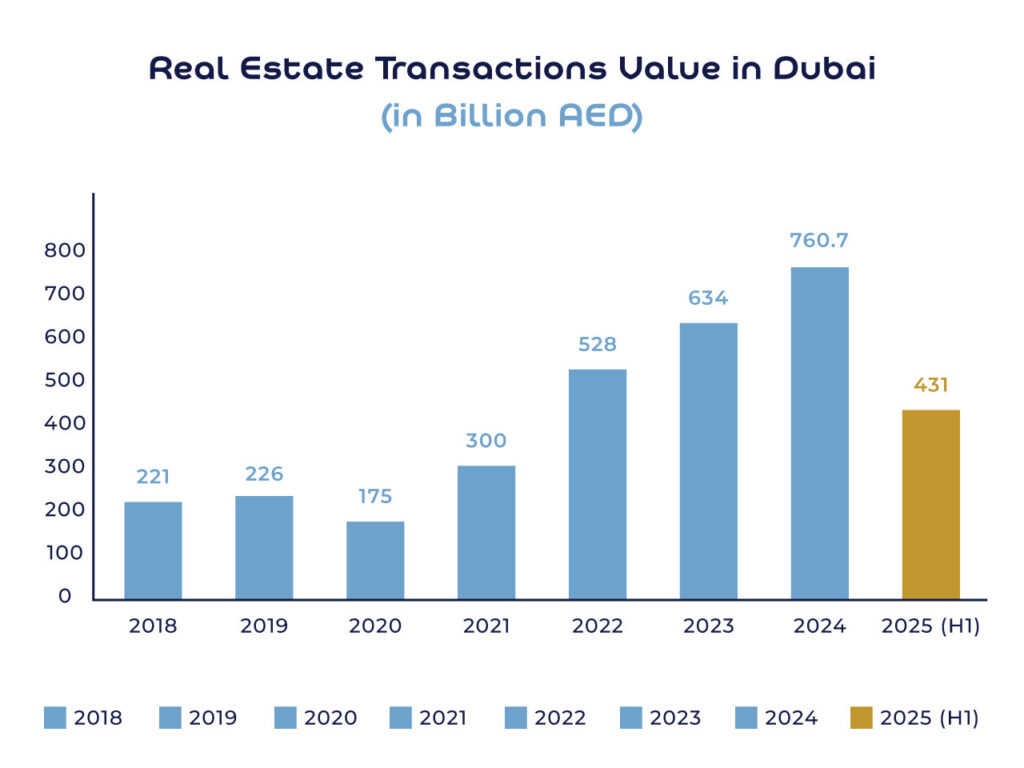

Dubai’s real estate sector has experienced remarkable growth in recent years. Between 2020 and 2024, the total value of real estate transactions in the city rose by 335%, and the momentum has continued even in the first half of 2025.

When massive investment flows into a sector and is paired with strong national and local leadership deeply committed to technology and the creation of a supportive regulatory environment, it creates fertile ground for transformative innovation. In Dubai’s real estate market, this innovation is being defined by blockchain, with real estate tokenization emerging as a force that is reshaping how property ownership and investments are structured and accessed.

What is Real Estate Tokenization?

Real estate tokenization represents ownership or economic rights in property through digital tokens recorded on a blockchain. Instead of purchasing entire properties that may cost millions, tokenization divides property value into smaller units (tokens).

Investors can purchase these tokens to own a fraction of the property, similar to buying shares in a company or units in a real estate fund. Tokens can also be traded on approved digital exchanges, introducing liquidity into an asset class that has traditionally been illiquid.

Why Real Estate Tokenization?

- Lower Barriers to Entry: Enables small-ticket investors to participate even in high-end real estate.

- Liquidity: Converts traditionally illiquid assets into tradable units.

- Global Access: Allows international investors to participate remotely.

- Automation: Smart contracts streamline rental income distribution and compliance.

- Transparency: Blockchain records every transaction immutably.

Essential Steps in Structuring a Tokenised Real Estate Offering

Tokenising real estate requires both a robust legal foundation and strong technological design. The process can be broadly divided into two key phases: Pre-Issuance Structuring, which establishes the framework for the asset and its tokenisation, and Post-Issuance Governance, which ensures security, compliance, and investor protection once the tokens are issued.

Structuring Phase 1: Pre-Issuance Framework

- Asset Due Diligence and Valuation: Independent valuation, title verification, and legal due diligence are undertaken to confirm ownership, authenticity, and market value of the property.

- Legal Structuring and Compliance: The issuing entity is required to obtain necessary licences and ensure that the underlying asset is legally transferred or structured through an approved entity, in accordance with applicable regulations.

- Smart Contract and Token Architecture: The blockchain network is selected and smart contracts are designed to define token behaviour, ownership rights, income distribution, and redemption terms.

- Token Issuance and Distribution: Upon completion of all legal and technical prerequisites, tokens are issued to investors under clearly defined terms and accompanying disclosure documents such as a whitepaper.

Structuring Phase 2: Post-Issuance Governance

- Custody and Reserve Management: Strong custody and reserve management are maintained based on regulatory obligations

- Security and Cybersecurity Measures: Robust security protocols are maintained across wallets, exchanges, and supporting infrastructure, including key-management controls, regular system audits, and digital safeguard mechanisms.

- Secondary Market Trading: Liquidity is facilitated through listing of tokens on compliant secondary marketplaces, with liquidity conditions determined by overall market maturity.

- Investor Protection and Dispute Resolution: Transparent disclosure standards, risk-management processes, redemption frameworks, and investor grievance-handling mechanisms are incorporated to uphold investor confidence.

- Governance and Compliance Reporting: Ongoing compliance is ensured through periodic audits, financial and transaction reporting, and public disclosure of reserve status and governance practices.

Tokenization of Title Deeds

In March 2025, the Dubai Land Department (DLD) launched its first “Real Estate Tokenization Project.” The initiative was developed in collaboration with Prypco Mint, the Virtual Assets Regulatory Authority (VARA), Dubai Future Foundation, the Central Bank of the UAE (CBUAE), and Zand Digital Bank, serving as the project’s banking partner. The project itself is a landmark achievement in formalising fractional property ownership and is expected to serve as a model for real estate tokenisation, where the government takes an active role in shaping a regulated, transparent, and investor-friendly property market. Both professionals and small investors could participate with as little as AED 2,000, gaining access to premium real estate and earning proportional rental income or capital gains.

Estimates suggest that by 2033, tokenized assets could represent 7% of Dubai’s real estate market, valued at around USD 60 billion.

How Big is the Market for Real Estate Tokenization?

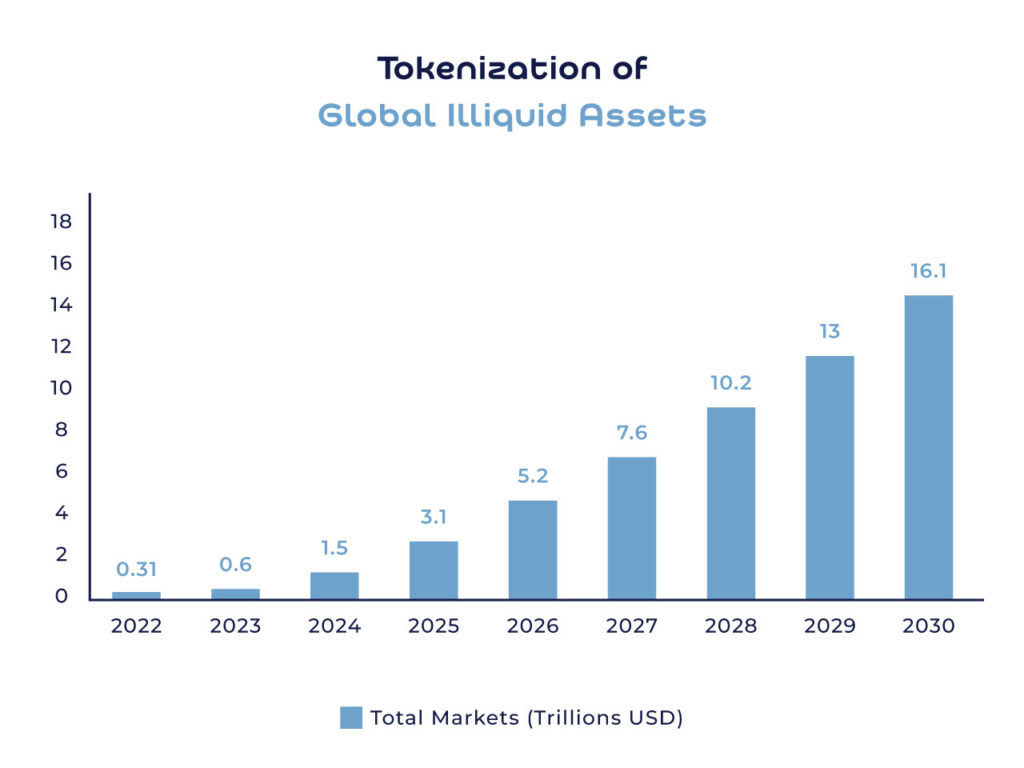

Tokenization of illiquid assets is projected to transform global markets. A BCG/ADDX study estimates tokenized assets could represent 10% of global GDP, approximately USD 16.1 trillion, by 2030. Deloitte forecasts tokenized property alone can reach USD 4 trillion by 2035. Dubai has already positioned itself to be an important part of this transformation.

How AKW Consultants Helps

The most important success factor in any real estate tokenisation project lies in achieving the right combination of technology, finance, and compliance, supported by a deep understanding of the UAE’s real estate sector. AKW Consultants’ technology team, along with legal and compliance specialists, work in alignment with VARA’s frameworks and regulatory requirements to ensure that all key regulatory and operational obligations are met.

AKW Consultants is proud to be an organisation that works closely with VARA, supporting clients in structuring and licensing their businesses while providing both advisory and technological expertise for real estate tokenisation projects. We were also honoured with the DMCC Rising Star Award for delivering measurable impact in the UAE consulting space, further strengthening our reputation as a trusted partner to our clients.