- Audit & Assurance, Governance & Risk Advisory, Precious Metals & Stones, Real Estate, Responsible Business

Responsible Sourcing of Gold from Conflict-Affected and High-Risk Areas (CAHRAs)

- | November 10, 2025

Risks Unknown

It was 2016, and Usain Bolt, one of the greatest sportsmen ever to walk on the face of the earth, was about to run on the 200-metre track at the Rio de Janeiro Olympics. Everyone was waiting for the inevitable to happen. The race began, and by the first turn, he had already left all the others far behind. Unsurprisingly, Usain Bolt, in his majestic grace, won the gold medal.

Cut to five years later. An AP investigation found that the Sao Paulo-based refiner, which provided the gold for the Rio de Janeiro Olympic medals, was linked to processing gold suspected of being mined illegally in the indigenous areas of the Amazon rainforest. According to another report, $388 million worth of gold was purchased from wildcat miners, known as garimpeiros, at 252 sites. The UCSB Library’s Exhibition on garimpeiros described how wildcat miners have plundered the most remote areas of the Amazon rainforest for gold for centuries. They have also been associated with violence, human rights abuses, and massive deforestation of the Amazon rainforest.

It’s important to note that further investigation also revealed that the gold from the same Sao Paulo-based refinery was purchased by more than 300 other publicly traded companies, which included some of the world’s leading multinational corporations. This incident shows how risks from illegal mining can have far-reaching consequences and how companies and even individuals can unknowingly become entangled in them. These risks are particularly significant for gold supply chains running into conflict-affected and high-risk areas, or CAHRAs.

What are Conflict-Affected and High-Risk Areas (CAHRAs)?

The gold supply chain provides employment opportunities to some of the most remote and impoverished communities around the world. The artisanal and small-scale gold mining (ASGM) sector, according to the World Gold Council, produces about 20% of the world’s newly minted gold and supports the livelihoods of approximately 20 million people.3 However, some areas where gold is mined, transported, and processed have also been associated with armed conflicts, human rights abuses, and political instability. This makes sourcing gold from these regions risky, as it may potentially fund such heinous criminal activities. These high-risk areas in the gold supply chain are called CAHRAs.

It is important to note, however, that gold sourced from suppliers with direct or indirect connections to CAHRAs does not automatically mean that there are human rights abuses or other violence linked to their operations. Nevertheless, because of the inherent risks, enhanced due diligence must be conducted on gold sourced from these regions. It is particularly important to remember that, due to the constantly evolving risks of conflict and violence, a definitive list of CAHRAs isn’t available. Also, a definitive list might have other far-reaching implications that we will discuss further.

Geographical Bias and the Dodd-Frank Act

Conflict minerals were initially associated with the Democratic Republic of the Congo (DRC) and adjoining countries. This stemmed from the Dodd-Frank Act, which was passed in response to the Financial Crisis of 2008 and enacted in 2010. Section 1502 of the Act mandated the companies to ensure that “conflict minerals,” such as tin, tantalum, tungsten, their ores, and gold, are not tied to the conflict in Congo and nearby countries. In fact, in 2013, after the Securities and Exchange Commission adopted Conflict Minerals Rules for Section 1502, companies were required to label products as ‘not found to be “DRC conflict-free”’, as per the International Energy Agency (IEA). Although this was later struck down by the DC Circuit Court, the geographical bias in defining conflict minerals and, by extension, CAHRA became a part of the public memory.

According to an article titled “Dodd-Frank 1502 and the Congo Crisis,” published by the Centre for Strategic and International Studies, Section 1502 of the Dodd-Frank Act led to a de facto boycott of mining products from the Congo’s eastern provinces. This resulted in joblessness and reduced income for the artisanal miners, which in turn caused crimes such as banditry and kidnapping. Essentially, the law treated the mineral trade as separate from politics and missed the complex nature of the entire process. This also led to the illegal trade of minerals from Congo to Rwanda, with Rwanda exporting them as their own products. In some sense, the law exacerbated the problem it was intending to cure. Tying gold supply chain risks to one particular geographical region, therefore, can have unforeseen economic and social repercussions and may also negatively impact the due diligence process.

The European Conflict Minerals Regulation has removed the geographical bias of the Dodd-Frank Act. Under the European Regulation, EU 2017/821, a list of CAHRAs in 30 countries is published and reviewed quarterly. Even this list is specified as “indicative” and “non-exhaustive.” Also, it is important to note that the geographical borders of some of these countries might be porous, and gold can be smuggled into adjoining areas and traded from there, as described earlier in the case of Congo and Rwanda. Therefore, instead of linking CAHRAs to any specific list of countries, it is more important to understand the risks associated with CAHRAs.

Risks Associated with Sourcing Gold from CAHRAs

The OECD’s five-step framework for the CAHRAs is at the heart of crafting rigorous due diligence processes for companies across the gold supply chain. First, companies should establish strong management systems with policies and procedures to trace and document their supply chain. Next, they need to map their supply chain and assess the risks associated with it.

Enhanced due diligence is essential for gold associated with CAHRAs, whether it originates from, passes through, or is processed in these regions. It is important to note that gold originating from countries with limited known reserves should also be treated as a potential red flag. Studying global trade data for gold can be an important way for refiners and precious metals dealers who regularly engage in the production and trade of gold to assess the risks of gold sourced from a particular country. For example, a report titled “Gold Trade Data” published by Global Witness found that in one year, Bolivia quadrupled its gold exports from the previous year without increasing its gold production. In fact, the report also cited that a Texas-based US gold refinery alone sourced 6.6 tonnes of gold from Bolivia when the country in total produced only 6.3 tonnes of gold. Of course, there can be several factors causing this, but a discrepancy of such proportion is a definite red flag.

It is also important to note that some regions can serve as transit points for gold traded out of CAHRAs or for processing gold originating in CAHRAs. Both should be considered red flags and enhanced due diligence should also be conducted on gold linked to these areas. Suppliers who operate or have shareholding interests in operations located in CAHRAs are also considered high-risk. If they sourced gold from CAHRAs in the last 12 months or have inconsistent or incomplete KYC, enhanced due diligence is required to mitigate risks.

The risks associated with the delivery channels of gold to customers are also significant. Delivering gold to unrelated third parties not directly involved in typical business operations could indicate potential illegal activities. Using couriers or transport companies without adequate safety measures can also lead to security threats during transportation. There could be potential theft, tampering, or loss during transport or storage. Using identifiable security-sealed boxes is important for maintaining security throughout the supply chain.

Once the risks associated with gold supply chains are identified, companies should develop and implement a risk management strategy to mitigate these risks. Conducting site-based due diligence on gold suppliers and having stakeholder engagement should be an essential part of a company’s risk control plan. Regular independent third-party audits should be conducted to ensure that all regulatory compliance is in place. Apart from refiners, the OECD has also crafted specific risk identification and mitigation steps for different upstream and downstream actors along the gold supply chain to help them strengthen their due diligence mechanisms.

Nuanced Expertise in Risk Mitigation

Apart from the European Union’s indicative CAHRA list referred to above, other organisations also document conflicts and violence around the world. The Heidelberg Institute for International Conflict Research’s Conflict Barometer reports on political conflicts worldwide; the Geneva Academy of International Humanitarian Law and Human Rights’ Rulac Project identifies, classifies, and provides information on armed conflicts; and the Uppsala Conflict Data Program14 provides data on organised violence, including civil wars.

These resources are often used to determine regions afflicted by conflict and violence. The Responsible Minerals Initiative’s Global Risk Map is also an important tool that provides information on CAHRAs and other ESG risks, both nationally and sub-nationally. However, it is important that instead of relying on a static list, professionals apply judgement based on updated available information to assess risks and accordingly undertake enhanced due diligence.

The UAE Ministry of Economy & Tourism: Paving the Way for Responsible Sourcing of Gold

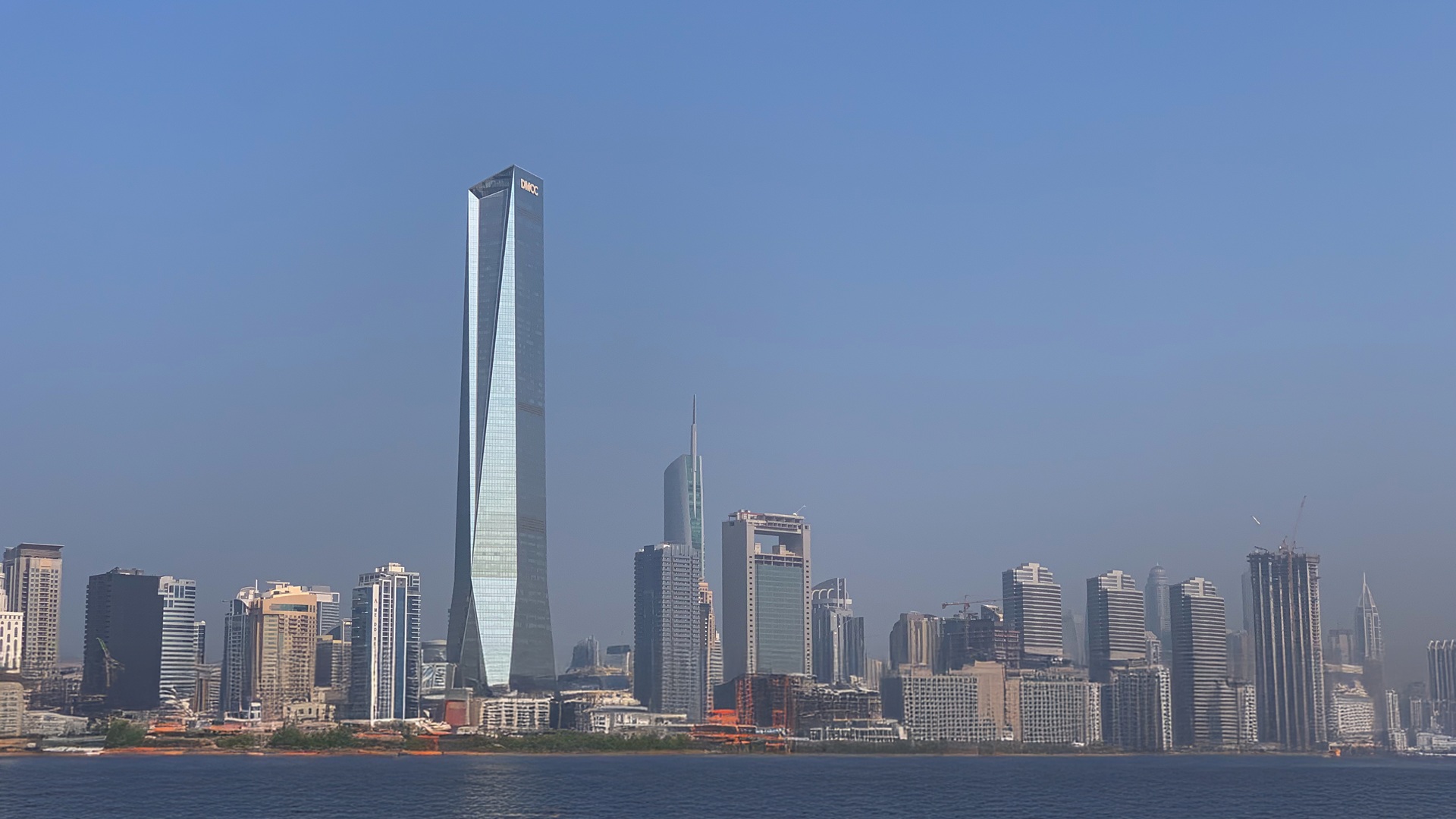

The UAE’s Ministry of Economy (MOET) and DMCC have been working relentlessly to promote ethical trade and responsible sourcing in the precious metals sector. To ensure that gold is sourced responsibly and does not contribute to conflicts, money laundering, human rights abuses and environmental degradation, the UAE Government has established a stringent Regulatory Framework in line with the international standards and best practices to strengthen compliance. The Regulatory Framework includes several Decrees and Regulations periodically developed since 2018. The more recent ones include the Due Diligence Regulations for Responsible Sourcing of Gold based on the OECD five-step framework, published in August 2022 for the Refineries, and the Ministerial Decree No. (68) published in March 2024, extending the first three steps of the risk-based due diligence to relevant entities in the supply chain and precious metal dealers. The Regulations mandate that the Refineries in the UAE will be subject to annual independent third-party review by an accredited reviewer.

AKW Consultants has played a very important role in this endeavour of the UAE Government, as it is one of the few accredited UAE Good Delivery Reviewers in the country. The firm, since the enactment of the regulations, has been working in the precious metals sector and with the UAE Regulators to improve compliance and governance. The good news is that several Regulated Entities within the UAE in the precious metals sector are proactively working towards building a responsible supply chain. They have commissioned AKW Consultants to execute several engagements to improve supply chain compliance. These include third-party annual reviews, site-based due diligence in Africa and Latin America, and capacity building and training on responsible sourcing. The growing number of such engagements reflects not only the Government’s commitment to strengthening oversight but also the industry’s willingness to align with international best practices. Together, these efforts mark a decisive step toward positioning the UAE as a global leader in the responsible sourcing of precious metals.