- Business Strategy Advisory, Tax

UK’s Non-Dom Abolition: HNWIs Moving to the UAE

- | November 10, 2025

The End of Non-Dom Regime

When the Finance Act 2025 received Royal Assent on 20th March 2025, it marked the end of Britain’s centuries-old “non-dom” regime, the framework that allowed certain residents to limit how their foreign income was taxed.

But who, exactly, were the “non-doms”?

In simple terms, “non-doms” were individuals who lived in the United Kingdom but their permanent home, or “domicile,” was abroad. This tax status meant that they were only taxed on income and gains arising within the UK, while their foreign income was taxed only if brought, or “remitted,” into the country. To use this regime beyond an initial period, individuals paid a fixed annual Remittance Basis Charge of £30,000 after being UK resident for at least seven of the previous nine tax years, or £60,000 after twelve of the previous fourteen. A Warwick study cited that, “three in ten individuals who earned £5 million or more claimed non-dom status in 2018, and a further one in ten had claimed non-dom status at some point in the past.”

Starting 6th April 2025, however, the UK moved from a domicile-based system to one based purely on residence. In simple terms, anyone who lives in the UK long enough to be considered a tax resident will now pay tax on their worldwide income and gains, regardless of where their “domicile” is.

By removing the distinction between residents based on domicile, the government closed a long-standing tax advantage that had made London a preferred base for international wealth.

Foreign Income and Gains (FIG) Relief

To ease the transition from the non-dom regime to the new residence-based system, the UK government introduced a four-year Foreign Income and Gains (FIG) relief. It applies to individuals who were non-resident in the UK for the previous ten consecutive tax years. For their first four years after arrival, they will not pay UK tax on any foreign income or gains, even if that money is brought into the country. After that period, the same worldwide tax rules apply as for all other UK residents.

Policymakers argued that the old non-dom rules encouraged wealth to remain offshore and eroded fairness: UK residents paid tax on global earnings, while non-doms did not. The government described the objective of the reform as: “addressing unfairness in the tax system, so that everyone who is a long-term resident in the UK pays their taxes here.”

Several economists, however, continue to warn that this step could undermine Britain’s competitiveness in attracting international capital and entrepreneurial talent.

Early Economic Forecasts and Migration Trends

- Adam Smith Institute projected that if around 11,050 non-doms left the UK, the economy could face up to £111 billion in cumulative lost growth by 2035 and more than 44,000 fewer jobs by 2030, due to reduced investment, consumption, and tax revenues.

- Oxford Economics (Sept 2024) found that 67 % of remittance basis users said they would not have relocated to the UK under the new rules, and 63 % planned to leave within two years.

- Henley Private Wealth Migration Report 2025 expects a net outflow of 16,500 UK millionaires in 2025, several times the net outflow in 2023.

Where the Money Is Going

The UAE has emerged as the leading destination for global wealth migration in 2025, with a projected net inflow of around 9,800 millionaires, the highest in the world, according to Henley & Partners’ Private Wealth Migration Report. The country is estimated to have seen a 98% rise in its millionaire population over the past decade, between 2014 and 2024. In 2024, more than 800 UK millionaires were estimated to have been relocated to the Emirates.

What Makes the UAE So Attractive?

There are several reasons why HNWIs prefer the UAE, but the difference in the taxation regimes between the UK and the UAE is striking and is certainly one of the important factors.

| Annual Levy | United Kingdom | United Arab Emirates |

|---|---|---|

| Personal income tax | Up to 45%, for incomes after allowances over £125,141 | 0% |

| Corporate tax | 25%, above £250k profit | 9% for taxable income above AED 375K (0% on qualifying income of QFZPs) |

| Standard VAT | 20% | 9% |

In fact, according to a study made by the Taxpayers’ Alliance, the top 20 per cent of households in the UK will pay £2,962,905 in taxes over a lifetime. For these groups of people, paying off their lifetime tax would take over 20 years. Add to that the recent abolition of the non-dom regime, and the resulting tax on global income has only strengthened the incentive for HNWIs to move out of the UK and into the UAE.

Beyond tax, the UAE offers political stability, one of the world’s safest urban environments, and a more than 88 % expatriate population, as per estimates. Coupled with an ambitious, tech-driven diversification agenda, it presents itself as a secure and forward-looking jurisdiction for wealth preservation and growth.

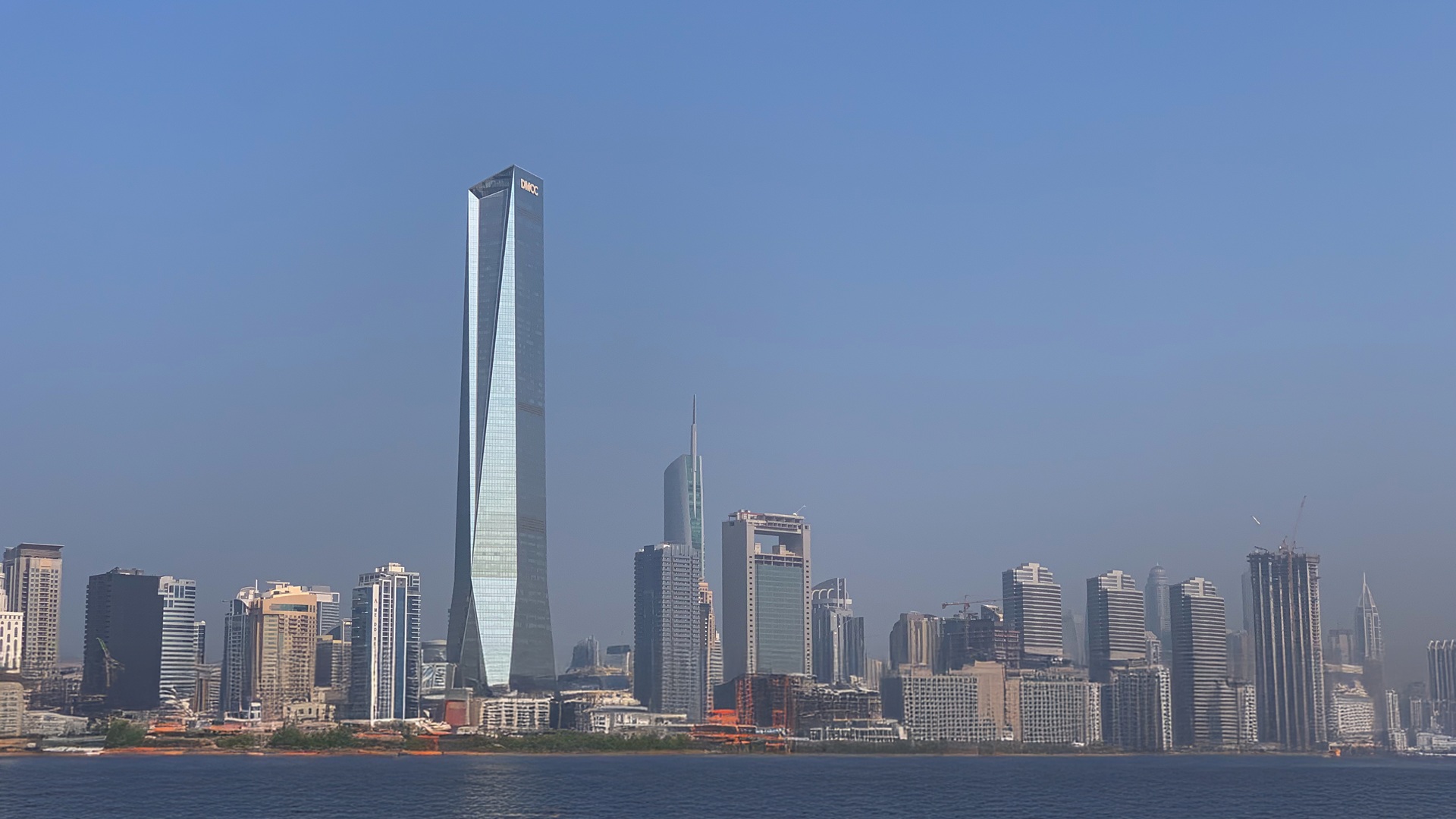

DMCC and the New Jurisdiction of Global Wealth

Within the UAE, Dubai Multi Commodities Centre (DMCC) has played a particularly important role in attracting this new wave of high-net-worth individuals (HNWIs). The free zone brings together family offices, investment firms, and specialised service providers within a single ecosystem. It offers flexible licencing structures and premium-grade infrastructure to millionaires moving into the UAE.

The DMCC Wealth Hub, in particular, serves as Dubai’s leading district for private wealth management, a platform that simplifies operations by helping members manage regulatory requirements, control costs, and access exclusive investment opportunities. Already home to more than 1,800 companies, DMCC Wealth Hub continues to expand its appeal, supported by a forecasted 58% rise in bankable financial assets across the UAE in the next five years.

As a DMCC-registered agent and a winner of the DMCC Rising Star Award, AKW Consultants has been supporting this shift, working with HNWIs who see the UAE not just as a destination, but as a place to build lasting enterprise. We bring together practical expertise in business setup, Golden Visa facilitation, tax and regulatory advisory, real estate sourcing, and compliance, strengthened by our role as a government-approved auditor under the UAE’s Ministry of Economy and Tourism (MoET).