UAE Free Zone Companies: Who Can Enjoy the Zero Corporate Tax Regime?

- | July 16, 2024

Introduction

How important are Special Economic Zones (SEZs) to the growth of a nation?

In the 1970s, Shenzhen was a small village in China with a population of around 30,000. In 1980, it was declared one of China’s four SEZs and the miracle began to unfold. Between 1979 and 2019, the GDP per capita of Shenzhen grew by an astounding 33,479%! During the same period, the GDP of China rose more than 54 times from $263.71 billion to $14,279.97 billion. The correlation between SEZs and the growth of an economy, therefore, could not be overstated. Right from the first free zone at Shannon Airport established in 1959 to 7,000 special economic zones spread across 145 economies in 2022, SEZs have been critical to globalization and the proliferation of a free market economy around the world.

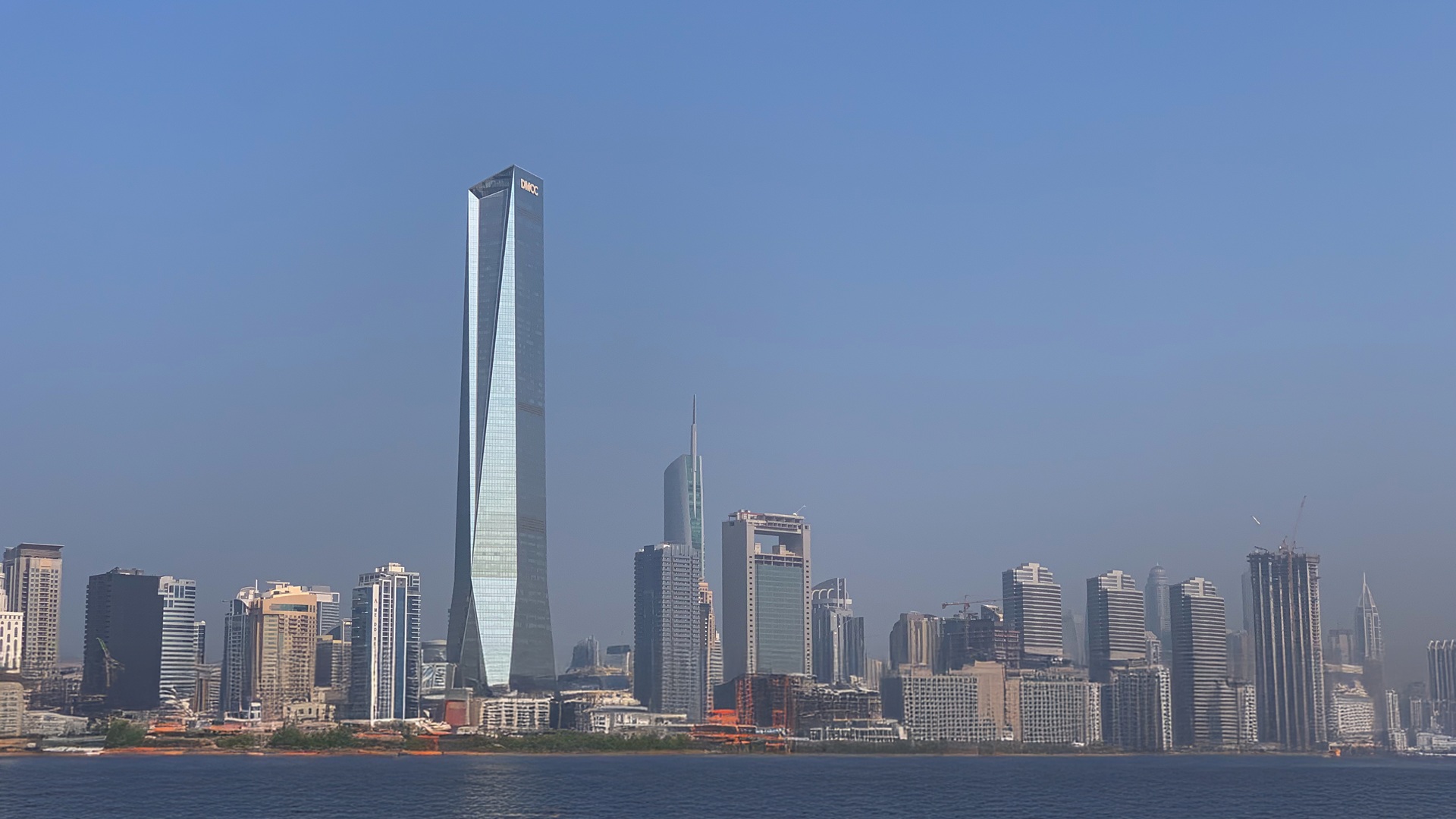

The UAE has been a global leader in establishing free zones, a type of SEZ that provides multiple benefits to businesses established there. According to FDi Intelligence, six of the world’s top ten free zones were in the UAE in 2023. In fact, The Dubai Multi Commodities Centre (DMCC), the “world’s leading SEZ,” has been able to bag the top position as the Global Free Zone of the Year for nine years in a row. Undoubtedly, these free zones have been instrumental in positioning the UAE as a global hub for foreign investments.

To maintain the appeal of these business-friendly free zones to investors worldwide, the UAE has adopted a host of significant policy initiatives, including implementing a 0% corporate tax for free zone companies that meet certain requirements. In this blog, we will explore these free zone companies and the conditions that they must fulfil to enjoy the zero corporate tax regime under the UAE’s Corporate Tax Law.

Who Can Benefit from the Zero Corporate Tax Regime?

Corporate tax was introduced in the UAE in 2022. Under Corporate Tax Law, companies with Taxable Income under AED 375,000 across both the mainland and free zones, as well as the Qualifying Income of Qualifying Free Zone Persons (QFZPs) are eligible for a zero corporate tax rate. This blog will specifically explore zero corporate tax as it applies to the second category of taxpayers—the QFZPs.

Article 18 of the Corporate Tax Law specifies the conditions that free zone companies and branches must meet to become QFZPs and benefit from a zero corporate tax regime. To understand the provisions of this law, two fundamental questions need to be answered:

- Who is a Qualifying Free Zone Person (QFZP)?

- What are the Qualifying Activities?

Follow AKW Consultants on WhatsApp Channels for the latest updates.

Qualifying Free Zone Person (QFZP) and Qualifying Activities

A Free Zone Person is a juridical person, which is an organisation such as a partnership or a corporation with rights and responsibilities. As explained in the Corporate Tax Guide for Free Zone Persons issued in May 2024, a Free Zone Person is an entity “incorporated, established, or otherwise registered in a free zone.” A Free Zone Person can be a company with its head office or branch in the free zone. However, zero corporate tax on Qualifying Income applies only to the portion of the business that is registered in the free zone.

The Qualifying Income of a QFZP is the income derived from Qualifying Activities with other free zone and non-free zone persons. It could be income derived from Qualifying Intellectual Property as well. However, for the Qualifying Income to receive the corporate tax benefit, it also needs to fulfil the de minimis requirement, which we shall discuss later in the blog.

Ministerial Decision No. (265) of 2023 has detailed the Qualifying and Excluded Activities under the UAE Corporate Tax Law. Qualifying Activities include manufacturing, processing, and distribution of goods or materials, logistic services, wealth and investment management services, and ancillary activities related to each of them. The detailed lists of Qualifying and Excluded Activities can be found here.

Conditions to Be a Qualifying Free Zone Person

To be a Qualifying Free Zone Person eligible for the zero corporate tax regime, a Free Zone Person must meet the conditions summarised here:

- Maintaining Adequate Substance in a Free Zone: The Free Zone Person must undertake its core income-generating activities in a Free Zone. It must have adequate assets, full-time employees, and make sufficient expenditures to carry out these activities.

- Deriving Qualifying Income: The Free Zone Person must derive income from transactions with other free zone persons or from Qualifying Activities with other Free Zone and Non-Free Zone Persons. Income from Qualifying Intellectual Property, such as patents or copyrighted software, is considered Qualifying Income. However, income from Domestic or International Permanent Establishments of a QFZP will still be taxed at 9% under the Corporate Tax Law. Additionally, a Free Zone Person must meet the de minimis requirements, which specify that the total non-qualifying revenue must not exceed the lower of:

- AED 5 million

- 5% of its total revenue

Cabinet Decision No. 100 of 2023, repealing Cabinet Decision No. 55 of 2023, has detailed the regulations related to determining Qualifying Income for the QFZPs.

- Not Electing to Be Subject to Regular Corporate Tax: Article 19 of the Corporate Tax Law allows a Qualifying Free Zone Person to elect to be subject to the regular corporate tax rate. If a QFZP indeed does that then the 0% corporate tax rate does not apply to it.

- Complying with the Arm’s Length Principle and Maintaining Transfer Pricing Documentation: Transactions among related parties must be conducted as if they were between independent parties. For example, transactions between a free zone parent company and its subsidiary, such as a Domestic Permanent Establishment, should follow this principle. Adequate Transfer Pricing documentation must be maintained to demonstrate compliance.

Transfer Pricing refers to the transactions or arrangements between related parties. As the Transfer Pricing Guide explains, commercial relationships between two independent parties are typically governed by market forces. However, related parties, as described in the Arm’s Length Principle, may not be subject to the same market-driven pricing for goods and services. Therefore, a Qualifying Free Zone Person (QFZP) must prepare and maintain adequate Transfer Pricing documentation to demonstrate compliance with the Arm’s Length Principle. Depending on the size of the business, different types of transfer pricing documentation will be required.

- Maintaining Audited Financial Statements: The Free Zone Person is required to prepare and maintain financial statements, regardless of revenue amount. These statements need to be audited by an independent audit firm.

A Free Zone Person must comply with all of the conditions required to be a QFZP and maintain all relevant documents and records to demonstrate compliance with the conditions. If it fails to meet any of the required conditions then it will lose its QFZP status for that tax period along with four subsequent tax periods, and therefore, the importance of rigorously meeting the conditions required to be a QFZP could not be overstated. For a detailed understanding of the conditions, FTA’s Corporate Tax Guide for Free Zone Persons should be referred to.

The Importance of UAE’s Free Zones in Attracting Investments

The UAE’s free zones have been instrumental in sculpting the country’s growth story. Between 2015 and 2021, free zone exports in the UAE consistently accounted for more than 60% of the total exports compared to non-free zone exports. In 2020, more than 55% of re-exports were from free zones.

A publication by Middlesex University, Dubai emphasised the contribution of UAE’s free zones in attracting foreign direct investment (FDI), highlighting how the UAE has outperformed major economies such as the USA, China, and India in terms of the FDI/GDP ratio. An initiative such as the NextGenFDI, launched by the Ministry of Economy in partnership with multiple free zones to attract digitally enabled businesses from all over the world, testifies to the importance of free zones in attracting foreign investments to the UAE. In 2022, the UAE attracted $22.7 billion (AED 83 billion) in FDI, which was 10% more than in 2021. In terms of FDI inflows, the UAE stands far ahead in both the West Asian region and the MENA region, accounting for 47.1% of the total FDI inflow in West Asia and 32.4% of the total inflow in MENA countries in 2022.

Source: Ministry of Economy

Conclusion

The tax-friendly atmosphere of the UAE goes beyond the zero corporate tax regime for the free zone companies. The 9% corporate tax on taxable income above 375,000 AED is substantially lower than the combined corporate tax rate of several other countries in the world as cited here. Nevertheless, the zero corporate tax regime on the Qualifying Income of a Qualifying Free Zone Person will continue to be an important point of attraction for investors worldwide.

However, it is important to understand that determining Qualifying Income involves complicated calculations and a thorough understanding of Corporate Tax Law and several other related regulations. Transfer Pricing documentation and preparing audited financial statements can also be challenging for businesses. Most importantly, as stated earlier, if a company loses its QFZP status, it will not be able to receive the benefits of a zero corporate tax regime for that tax period and for the four subsequent tax periods after that. Hence, free zone companies need to consult experts in corporate tax to determine the scope, applicability, and requirements for compliance under the UAE’s Corporate Tax Law for availing zero corporate tax regime.

AKW Consultants’ corporate tax consultant can help your free zone company benefit from the UAE’s zero corporate tax rate by ensuring rigorous compliance with regulatory requirements.

Read Also: The Impact of Corporate Tax on Foreign Investment in the UAE