Why are UK Expats Looking to Set Up a Business in the UAE?

- | May 20, 2024

Introduction

The economic landscape is rarely static. Economic cycles and overall technological progress create disruptions that characterise the continuous evolution of global businesses. Although the UK has dominated technological innovation and economic growth for centuries, the rapid shift in global dynamics has led many UK expats to explore new business opportunities elsewhere. The UAE has become one such place that has been able to capture the dreams of UK expats, with over 5,000 British companies and more than 100,000 UK nationals calling it their home.

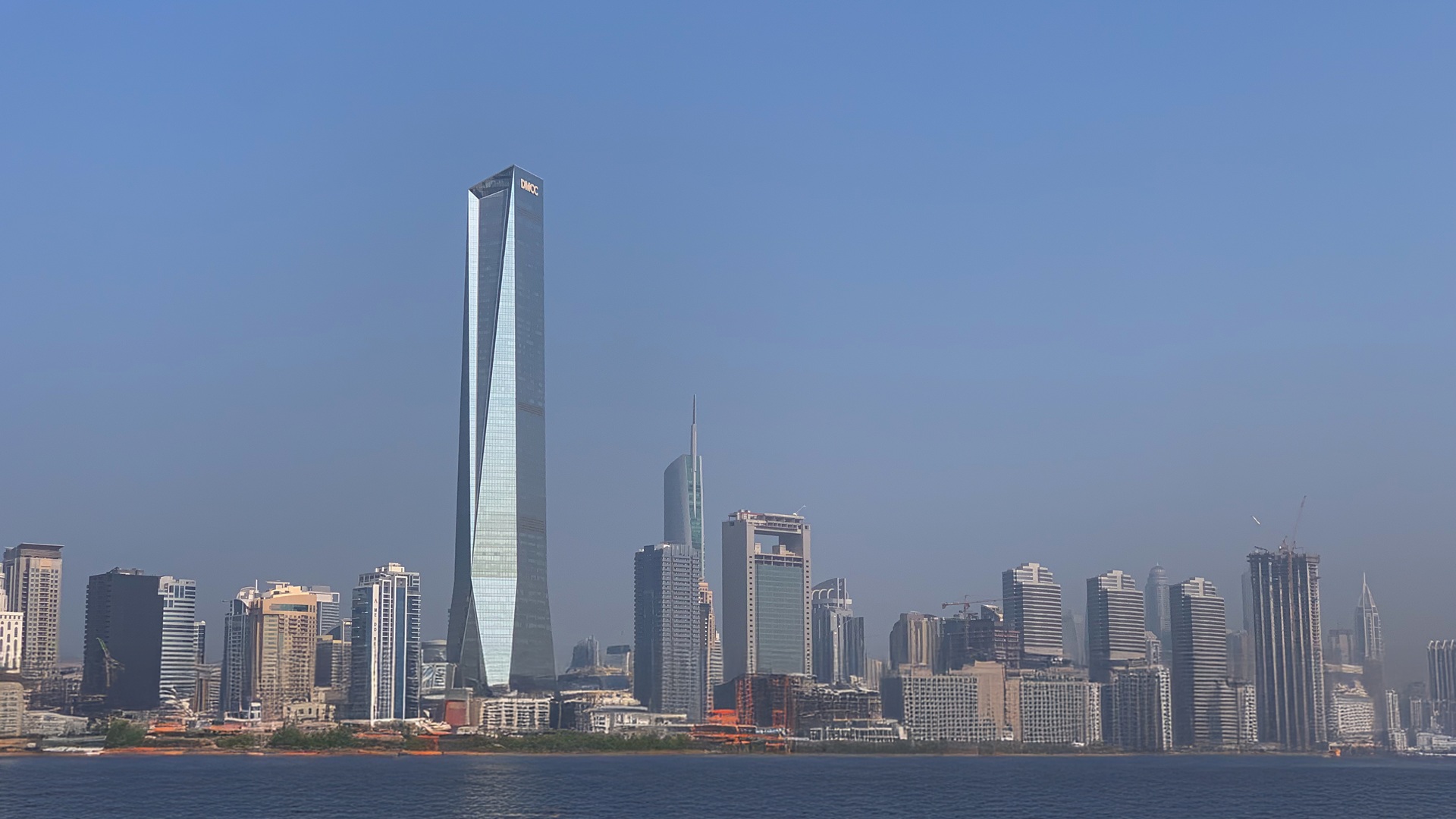

The skyline of its glorious cities represents the aspirations of millions who live and work in the UAE. Just a look at UAE’s initiatives reveals the depth of this aspiration crafted by its able leadership. With ‘The Emirates Blockchain Strategy,’ ‘UAE Strategy for the Fourth Industrial Revolution’, ‘National Program for Artificial Intelligence 2031,’ and ‘UAE Circular Economy Policy,’ the UAE demonstrates its determination to pave the path toward a future economy based on technology and sustainability.

In this blog, we will look at the UAE’s remarkable growth story and understand the top 5 reasons UK expats are looking to set up a business in the UAE.

Top 5 Reasons UK Expats Want to Set Up a Business in the UAE

UAE’s economic leadership has made it an ideal destination for UK expats aspiring to start their business ventures. Here are the top 5 reasons why the UAE has become their favourite destination:

1. Economic Growth

In 2000, the UK’s economy was almost 16 times the size of the UAE’s economy. By 2022, it was only six times as large. So, what happened in these years? Between 2000 and 2022, the UAE grew by almost 500%, while the UK grew by only 87%. Of course, with the UAE starting from a smaller base, it was comparatively easier for it to grow. However, growing five times at a consistent pace for over two decades is an extraordinary achievement for any country, especially considering the 2008 financial crisis and the COVID pandemic happening in between. This growth trajectory makes the UAE one of the most lucrative destinations for UK expats seeking to set up a business.

Follow AKW Consultants on WhatsApp Channels for the latest updates.

2. Favourable Tax Regimes

The country’s tax regime makes it one of the greatest destinations for UK expats wanting to set up a business in the UAE. The Emirates has a 0% corporate tax on taxable income up to AED 375,000 (approximately £80,674 as of May 17, 2024), and only a 9% corporate tax rate above this threshold. In contrast, the UK has a corporate tax rate of 25% for companies with profits over £250,000. Also, the UAE does not levy personal income tax, whereas in the UK the personal income tax can go up to 45%.

Here’s a brief comparison of the UK and the UAE’s Tax regimes:

| Tax Category | UK | UAE |

|---|---|---|

| Corporate Tax | 19% (Small profits rate) on companies with profits under £50,000) | 0% on taxable income up to AED 375,000 (~£ 80,574 as of 16.05.2024) |

| 25% (Main rate) on companies with profits over £250,000 | 9% on taxable income above AED 375,000 | |

| 0% for qualifying income of “Qualifying Free Zone Persons (QFZP)” | ||

| 9% for non-qualifying income of “Qualifying Free Zone Persons (QFZP)” | ||

| Personal Income Tax | Up to 45% | Not Levied |

| Value Added Tax (VAT) | Standard Rate of 20% | Standard Rate of 5% |

The greatest benefits for UK expats looking to set up a business in the UAE are the free zones. With more than 40 multidisciplinary free zones that allow expats and investors to have 100% ownership of their companies along with 100% repatriation of capital and profits, the UAE has become a favourite destination for foreign businesses, including UK expats. Moreover, there is a 0% corporate tax on the qualifying income of “Qualifying Free Zone Persons” that further enhances the attractiveness of these zones.

3. Foreign Investment

The UAE has become one of the most preferred destinations for foreign investors worldwide. It is the third largest FDI market globally, with 1,277 projects attracting $23 billion in investment. Glenn Barklie, Principal Economist and Head of FDI Services at GlobalData, characterised the UAE as a “real safe haven for investors.” However, the UAE is not content and plans to attract AED 550 billion ($149.7 billion) in FDI by 2030 and AED one trillion by 2051. Indeed, Dubai is leading this ambition from the front. According to Financial Times’ ‘fDi Markets,’ Dubai topped the world list in attracting global Greenfield FDI projects for the third successive year, attracting 148% more projects than London.

In contrast, the Financial Times reported that since the Brexit referendum, the “drop in the number of FDI projects has been particularly acute.” In 2022, the UK’s foreign direct investment (FDI) net inflows were 1.5% of its GDP, whereas for the UAE, it was 4.5%. This proves that the UAE’s favourable investment climate has significantly helped the country to attract foreign investors. UK expats are also looking to set up a business in the UAE to leverage these FDI inflows and grow in the process.

4. Quality of Life

The UAE is one of the most prominent cosmopolitan countries in the world. As per Global Media Insights’ research, 88.5% of the total number of people living in the UAE are expats. UK Expats also find the UAE a desirable destination for the luxurious lifestyle, diversity, and growth opportunities it offers. According to the Expat Insider 2023, the UAE has been ranked the 4th best country in the world in overall Quality of Life, above most European and North American countries. The report measures the quality of life across five different parameters: Leisure Options, Travel & Transit, Healthcare, Safety & Security, and Environment & Climate. In terms of career prospects, the UAE ranks second in the world, just below the USA. No wonder the UAE has been able to attract top talents from all across the world. Apart from enjoying the quality of life, UK expats who want to open a business in the UAE can have access to this large pool of talented professionals.

5. Location and Infrastructure

The UAE shares land borders with Oman and Saudi Arabia and sea borders with Iran and Qatar. Its strategic location, therefore, makes it a hub for trade with the entire Gulf Cooperation Council. The government has also made massive investments, establishing 10 airports and 12 seaports. UAE also has six national carriers that connect to 200 cities worldwide. In fact, 33% of the world’s population can reach the UAE within four hours and 66% within eight hours.

In 2023, UAE’s non-oil trade hit a record high of $953 billion, 12.6% above 2022. UAE also has a growing trade relationship with China. The total trade with UAE’s largest trading partner China reached AED 264.2 billion (USD 72 billion) in 2022, up from AED 223.8 billion (USD 61 billion) in 2021. This also makes the UAE a preferred business location for UK expats. By the end of Q3 2023, the UAE accounted for 1.8% of the total UK exports, amounting to £15.6 billion.

Long-term Residency Opportunities – The Golden Visa

UK expats who want to open a business in the UAE can obtain the Golden Visa to have a stable presence in the country as well as to ensure long-term residency for themselves and their families. The UAE government enables investors, entrepreneurs, pioneers of humanitarian work, and outstanding specialised talents such as doctors, scientists, and athletes, who fulfil certain criteria, to obtain a Golden Visa. This visa provides expats with a renewable residency and is valid for five or 10 years. Golden Visa holders don’t need a sponsor and can sponsor their family members themselves.

UK expats may choose to obtain a Golden Visa as an investor or an entrepreneur. Investors in public investments may obtain a Golden Visa for 10 years by submitting a letter from an investment fund confirming the investor has a deposit of AED two million that they own, along with a letter from the Federal Tax Authority confirming the investor pays the government no less than AED 250,000 in tax annually. Entrepreneurs may get the Golden Visa for five years by obtaining an approval letter for a project valued at no less than AED 500,000, provided the project is of a technical or future nature, based on risk and innovation. Owning properties with a combined value of no less than AED two million may also be used to obtain a five-year Golden Visa. There are other requirements that each of the above categories must fulfil. However, it’s important to note that the Golden Visa provides an excellent opportunity for businesses planning long-term growth.

Conclusion

The Dubai Frame truly represents the ambition of the UAE as a country. The connection between the old and the new isn’t simply a transition from the past to the present; it also metaphorically represents the country’s aspiration. What makes this aspiration even more encouraging is its deep commitment to sustainable growth. With time the UAE has gradually reduced its dependence on oil and diversified its economy. A glaring example of this is Dubai. According to Carbon Tracker, oil once accounted for 50% of Dubai’s GDP, but now it’s barely 1%.

UK expats understand the sheer opportunity that the UAE represents in the domain of sustainable growth. For UK expats who have already opened their businesses in the UAE, the tax regime provides the opportunity to reinvest saved capital into their businesses and further grow in the process. The growing foreign investment, strategic location, and access to an incredible talent pool also attract UK expats to open their businesses in the UAE.

If you are a UK expat looking to set up a new business in the UAE, then AKW Consultants can assist you in your journey and help you craft your success story.

Read Also: Why do some business strategies fail?